Dear member,

Starting today, you can apply to receive the Canada Emergency Response Benefit.

The benefit is available to self-employed persons as well as contract or salaried workers. The applicant must have lost his or her job or no longer have any income as a result of COVID-19. The parent who must stay home with the children because of the coronavirus pandemic can also apply.

Assistance will be sent online within 3-5 business days by direct deposit, and within 10 days by mail.

Those who file their taxes online and already have an online account with the Canada Revenue Agency (CRA) do not need to create a new account.

If you have a CRA account:

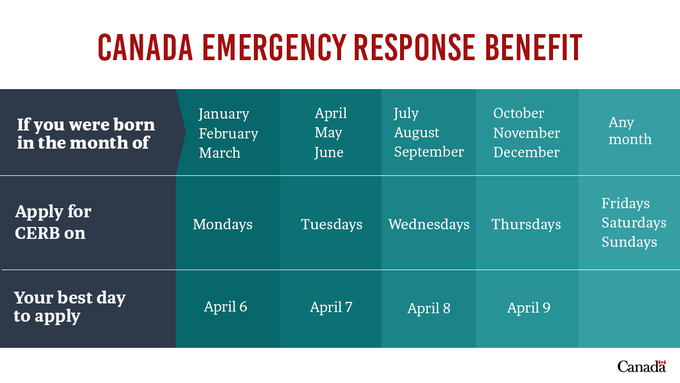

If you already have an account with the CRA, you must register by month of birth. For example, if you were born in January, February, and March, you must register on Mondays. You must reapply every 4 weeks to validate that your situation has not changed. A maximum of 4 weeks will be allowed (16 weeks).

If you don’t have CRA account:

Here is the step-by-step process if you don’t have CRA account.

1. Go to canada.ca

To create a file with the CRA, you must first go to the federal government site.

Choose your preferred language.

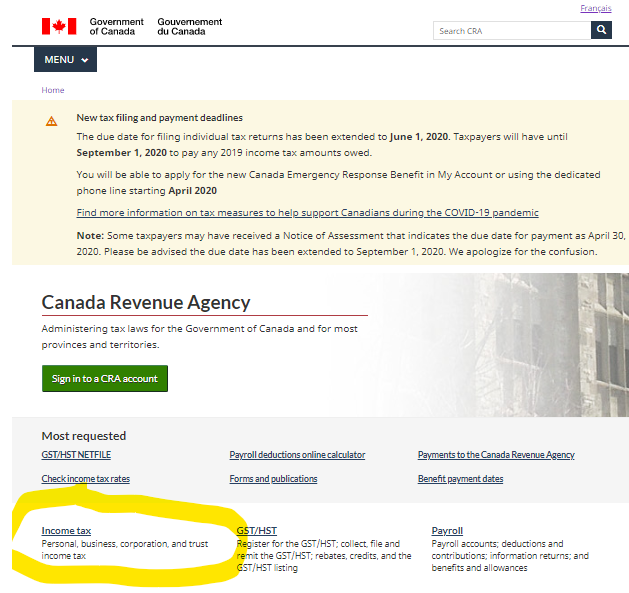

2. Click on Income tax

Slightly scroll down the page and you will find the option “Income tax”.

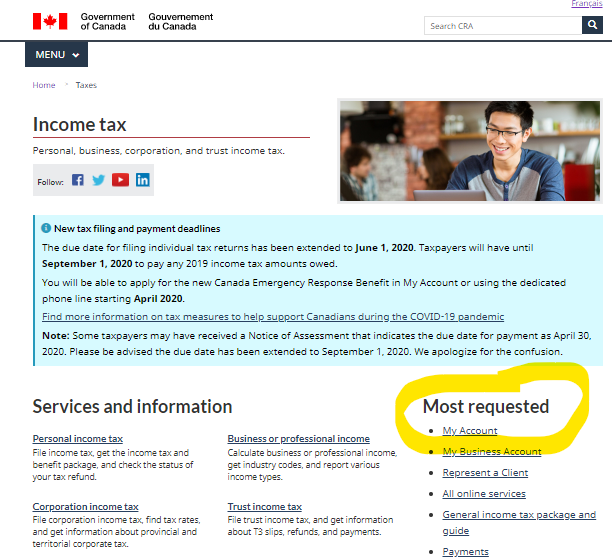

3. Click on My Account

On the right side of the screen, in the “Most requested” column, click on the first option: “My Account”.

4. Sign in

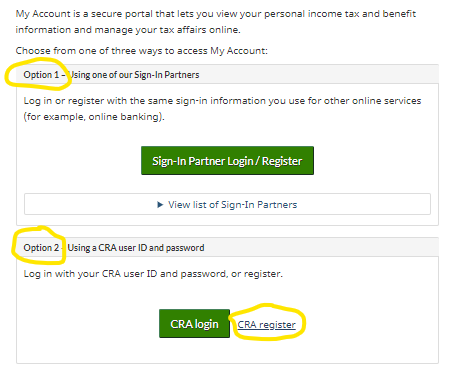

Two connection options are available.

Option 1 offers a connection with a partner, either from a financial institution’s online account. To choose this option, you must already be using a financial institution’s online services.

Option 2 offers you the option of logging in from an account created directly with the CRA. To create your account, click on “CRA register”.

Once you have your code, go to canada.ca/pcu-coronavirus.

By phone:

After dialing the number, simply choose English or French as your preferred language and follow the instructions.

You’ll need:

- your social insurance number

- your postcode

- the period covered by the application

You end by certifying that you are entitled to the benefit.

You must reapply every 4 weeks to validate that your situation has not changed. A maximum of 4 weeks will be allowed (16 weeks).

With solidarity,

The IATSE 514 team